REITs and InvITs in India - An update

Published: Jul 12, 2021

By Shankar Iyer, Direct Tax Leader, DAA Consulting

WHILE Real Estate Investment Trusts (REITs) and Infrastructure Investment Trusts (InvITs) are a common global phenomenon, they are a relatively new product in the Indian landscape. REITs and InvITs have gained acceptance amongst Indian investors but they are yet to overcome the unique challenges posed to them by the Indian regulatory and commercial landscape.

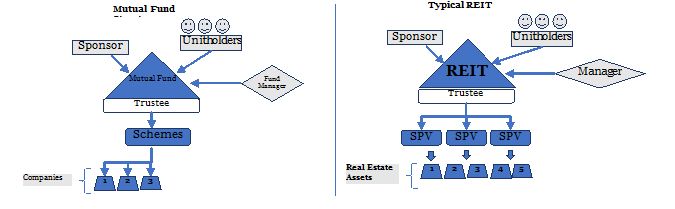

Traditionally, in India, real estate is owned in real property terms and owning securitized real estate assets is largely unknown. REITs distribute such ownership by adopting a mutual fund like model where investor could own the units representing/represented by underlying real estate property without any direct ownership therein. Basically, REITs are securities (units) with physical real estate as the underlying asset and such securities can be traded on the stock exchange after their listing. While REITs deal with commercial/residential real estate, InvITs deal with dedicated infrastructure projects such as ports, roads, dams, etc.

REITs regulations were introduced in 2014 by India's securities market regulator Securities and Exchange Board of India (SEBI) and subsequently operationalized in 2017. The first REIT was launched in 2019. So far, we have seen five InvITs (two publicly listed and three private) and two REITs in India.

|

Particulars |

InvITs |

REITs |

|

Publicly Listed |

- IRB InvIT Fund - India Grid Trust |

- Embassy Office Parks REIT (2019) - Mindspace Business Parks REIT |

|

Private |

- IndInfravit Trust, - India Infrastructure Trust, - Oriental Infra Trust |

|

Typical REIT Structure:

To encourage retail participation from investors, SEBI has reduced the minimum investment size to INR 50,000 for REITs and INR 100,000 for InvITs. However, in order to have a much wider market reach, it may need to make them more affordable and attractive akin to stocks; say, the minimum investment size could be reduced further to say, INR 5,000 or INR 10,000.

Unique benefits for investor community from REITs and InvITs

It offers a more scientific and reliable way to invest in real estate. Investors can participate in the growth of real estate assets without the hassles of buying actual real estate and it is almost like holding real estate in dematerialised form, just like stocks and e-gold.

REITs/InvITs product mix is suitable for persons who are looking for a regular source of income - can become a good secondary alternative source of safe and regular income like fixed deposits or debt mutual funds. It also offers a diversification of risk from regular asset classes like equity, debt and gold. Even within the real estate sector, it is possible for investors to target very high quality and diversified portfolio of real estate assets - something an individual cannot create by themselves.

For long term institutional investors like Insurance Companies and Pension Funds, this offers a good low-risk option. Infrastructure assets being long gestation assets, it also helps long term liabilities being better matched.

Even from a macroeconomic point of view, critical infrastructure projects could also be funded by InvITs thereby reducing burden on government resources. This in turn would also bear a multiplier impact on spurring industrial growth and hence GDP.

Key income tax implications to be borne in mind:

|

At SPV level |

Taxes to be paid at applicable corporate tax rates on the net income computed (comprising chiefly, rental income and capital gains derived from underlying real estate assets). |

|

At Trust level |

Interest income, dividend income, rental income derived from underlying real estate assets from SPV would be exempt from tax in hands of Trust. However, when distributing to unit holder, there would be an appropriate withholding at Trust level considering (a) residential status of unit holder (resident/non-resident), (b) whether SPV has availed concessional tax rate or paid maximum marginal tax rate. |

|

At unit holder level |

Tax on capital gains on sale of units depending on: (a) residential status of unit holder, (b) period of holding units, (c) listed or unlisted unit Dividend, interest or rental income (generated and passed on from SPV) would be taxable in hands of unit holder |

Recent SEBI Amendment for Foreign REITs/InvITs

India has its International Financial Services Centre (IFSC) located in GIFT City, Gujarat - a notified Special Economic Zone (SEZ). The IFSC is partially operational. Recently, SEBI issued a circular permitting listing of foreign InvITs and REITs on recognized stock exchanges in India's IFSC. This seems to be a step to incentivize global REITs and InVITs to list in Indian IFSC, provided they are:

- incorporated in permissible jurisdictions (US, UK, Japan, Canada, S Korea, France, Germany)

- regulated by securities market regulators in those jurisdictions

- listed on stock exchanges in those jurisdictions

Further, any stock exchange of a foreign jurisdiction may form a subsidiary to provide the services of stock exchange in IFSC where at least fifty-one per cent of paid up equity share capital is held by such foreign stock exchange and remaining shares may be offered to any other recognized stock exchange, whether Indian or of foreign jurisdiction.

While this is a welcome step to attract foreign REITs/InvITs to India, it is noteworthy that as of today, apart from the two nationally recognized Indian exchanges, NSE and BSE, no foreign stock exchange has made a foray in India's IFSC. Whether foreign InvITs and REITs would find it attractive enough to list on Indian bourses in IFSC would be the million-dollar question.

[The views expressed are strictly personal.]