Section 13 of SARFAESI ACT- Enforcement Of Security Interest

Published: Jul 31, 2019

By Shreya Kharbanda

Introduction

SARFAESI Act, 2002 ("Act") is an act which provides measures for recovery of defaulted loans by a Banks or Financial Institutions, without the intervention of courts or tribunals by adopting measures of recovery or reconstruction. The main object of introduction of SARFAESI Act is to provide measures for recovery of defaulted loans by banks or financial institutions without intervention of courts or tribunals by adopting measures of recovery or reconstruction. The Act aids the financial institutions to assess the quality of the asset and in furtherance of which they can distinguish them in performing assets or non-performing assets ("NPA").

Section 2(o) of the Act has defined non-performing asset as "an asset or account of a borrower, which has been classified by a bank or financial institution as sub-standard, doubtful or loss asset,-

(a) In case such bank or financial institution is administered or regulated by any authority or body established, constituted or appointed by any law for the time being in force, in accordance with the directions or guidelines relating to assets classifications issued by such authority or body;

(b) In any other case, in accordance with the directions or guidelines relating to assets classifications issued by the Reserve Bank."

Thus, after careful analysis of the definition of NPA, it can easily be deduced that any financial institution has to focus on reducing the number of NPA.

Methods of recovery of NPA

The Act provide for recovery for NPA in three ways:

- Securitisation

- Asset Reconstruction

- Enforcement of Security Interest without intervention of courts and tribunals

Section 13 of this Act pertains to Enforcement of Security Interest.

Object

The main object of this section is to facilitate the recovery of NPA by enforcing the security interest without intervention of courts or tribunals. The same has been enunciated in clause (1) of Section 13 of the Act. Adjudication by involvement of courts and tribunals can be tedious and expensive process and the aggrieved party in most cases seems to wonder if it is worth it. Thus, this provision of the Act provides recourse to such party.

Important terms

Section 2(f)- "borrower" means any person who has been granted financial assistance by any bank or financial institution or who has given any guarantee or created any mortgage or pledge as security for the financial assistance granted by any bank or financial institution and includes a person who becomes borrower of a securitisation company or reconstruction company consequent upon acquisition by it of any rights or interest of any bank or financial institution in relation to such financial assistance.

Section 2(j) - "default" means non-payment of any principal debt or interest thereon or any other amount payable by a borrower to any secured creditor consequent upon which the account of such borrower is classified as non-performing asset in the books of account of the secured creditor.

Section 2(zb)- "security agreement" means an agreement, instrument or any other document or arrangement under which security interest is created in favour of the secured creditor including the creation of mortgage by deposit of title deeds with the secured creditor.

Section 2(zc) - "secured asset" means the property on which security interest is created.

Section 2(zd) - "secured creditor" means any bank or financial institution or any consortium or group of banks or financial institutions and includes-

(i) debenture trustee appointed by any bank or financial institution; or

(ii) (ii) securitisation company or reconstruction company, whether acting as such or managing a trust set up by such securitisation company or reconstruction company for the securitisation or reconstruction, as the case may be; or

(iii) (iii) any other trustee holding securities on behalf of a bank or financial institution, in whose favour security interest is created for due repayment by any borrower of any financial assistance.

Section 2(ze) - "secured debt" means a debt which is secured by any security interest.

Section 2(zf)- "security interest" means right, title and interest of any kind whatsoever upon property, created in favour of any secured creditor and includes any mortgage, charge, hypothecation, assignment other than those specified in section 31.

Section 2(zg)- "security receipt" means a receipt or other security, issued by a securitisation company or reconstruction company to any qualified institutional buyer pursuant to a scheme, evidencing the purchase or acquisition by the holder thereof, of an undivided right, title or interest in the financial asset involved in securitisation.

Section 13 and Transfer of property act, 1882 ("TPA")

Section 13(1) of the Act states that "notwithstanding anything contained in section 69 or section 69A of the Transfer of Property Act, 1882, any security interest created in favour of any secured creditor may be enforced, without the intervention of court or tribunal, by such creditor in accordance with the provisions of this Act."

Section 69 and 69A of the TPA says that the mortgagee or any other person acting on his behalf shall have power to sell the mortgaged property in default of payment of mortgage-money without the intervention of Court. Section 69A deals with appointment of receiver for the purpose of Section 69.

Even though Transfer of property act, 1882 is a much earlier legislation but the Act is a special enactment. The power under the Transfer of property act, 1882 can only be exercised in certain cases. In other words, the power is subject to the provisions of this section. With the enactment of SARFAESI Act, any secured creditor can enforce his rights without following the conditions laid down in the respective provisions of Transfer of property act, 1882. While Transfer of property act, 1882 restricts the security interest into some types of mortgages and some places where the right can be exercised, provisions of SARFAESI Act applies to any security interest created in favour of any secured creditor.

In the case of Vishal N. Kalsaria V. Union of India (2016) 3 SCC 762, the Hon'ble Supreme Court held that the Act under Section 13(1) gets certain primacy over the TPA.

In para 112:

"… Under Section 13(1) of the Securitisation Act, limited primacy has been given to the right of a secured creditor to enforce security interest vis-à-vis Section 69 or Section 69A of the Transfer of property act.…"

Notice

For the purpose of such enforcement by Secured Creditor Section 13(2) provides that the said Creditor may serve a notice to the Borrower to discharge his liability in full to the Secured Creditors within sixty days from the date of such notice.

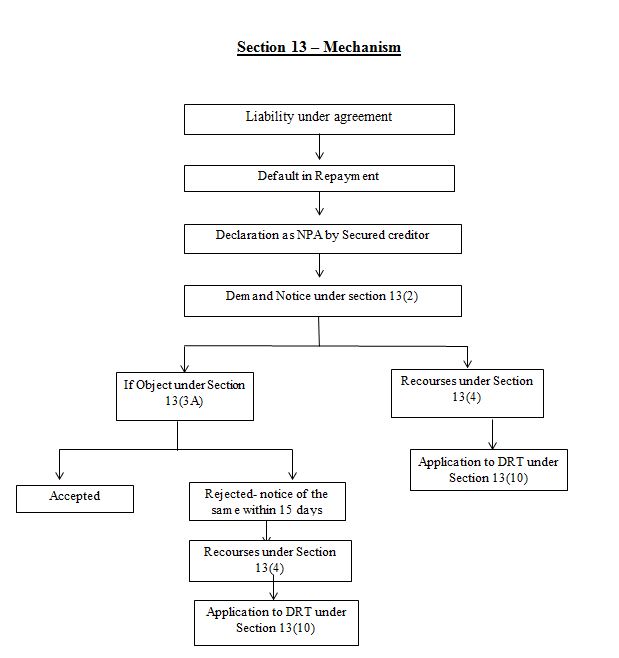

As according to Rule 2(b) of the Security Interest (Enforcement) Rules, 2002 ("Rules"), the notice is called Demand Notice and shall be delivered in accordance with the provisions of Rule 3 of Rules. This section will only be triggered only if borrower is under a liability under agreement and has made default in repayment or any instalment of the Secured creditor.

Proviso to Section 13(2) provides as follows:

(a) The requirement for classification as an NPA shall not apply to a borrower who has raised funds through issue of debt securities

(b) The methods of enforcement of security interest can be adopted by a debenture trustee with required modifications and in accordance with security agreements.

It is provided in section 13(3) that the above mentioned notice shall contain:

- Details of amount payable by the borrower

- Details of Secured assets intended to be enforced by Secured Creditor in event of non-payment of Secured debts by the Borrower.

Representation by Borrower

After the demand notice has been provided to the Borrower, Section 13(3A) gives the borrower a chance to make any representation or objection and secured creditor is bound to consider the same.

If the secured creditor is satisfied that such representation or objection is non-acceptable, then he has to inform the borrower the same with reason for non-acceptance within fifteen (15) days from the date of representation and such communication shall not confer any power, at this stage, upon the borrower to move to Debt Recovery Tribunal or Court of District Judge under Section 17 or 17A of the Act, respectively.

However, Rule AIR 2018 SC 3063 3A(b) of Rules provide that, if on consideration of such representation or objection, the secured creditor is satisfied that there is a need for a change or modification in demand notice he shall re-serve the modified notice within fifteen days.

The Hon'ble Supreme court of India, in ITC Limited v. Blue Coast Hotels Limited & Ors has stated that the provisions of Section 13(3A) of the Act are not merely directory rather mandatory in nature.

Recourse

If the Borrower fails to discharge his liability in full within specified time, section 13(4) provides certain recourses. He can choose to adopt either one or more than one. These recourses are-

(a) The secured creditor may take over the possession of secured assets. This would also include the right to transfer by way of lease, assignment or sale. This empowers the secured creditor to transfer the secured asset so as to realise the loan amount.

Rule 4 of the Rules prescribe the procedure for taking possession of a movable property. Rule 5 of the Rules states that after taking possession of the property authorized officer shall obtain estimated value and fix reserve price, in consultation with the secured creditor.

(b) The secured creditor may take over the management of business of the borrower including the right to transfer by way of leases, assignment or sale. However, this right to transfer can only be exercised where substantial part of business is held as security (First Proviso to section 13(4)(b)). Further, the secured creditor can take over the management of that part of business which is relatable to security, if management of whole or part of business is severable (Second Proviso to section 13(4)(b)).

(c) The secured creditor may appoint any person as manager to manage the assets whose possession has already been taken over. Rule 10 of the Rules, provides provisions pertaining to appointment of such manager.

(d) The secured creditor may through notice in writing ask any person who has acquired any asset or from which any money is due or will become due in future to borrower, to pay him as much money sufficient to pay the secured debt.

The Hon'ble Supreme court of Indian in Mardia Chemicals Ltd. & Ors v. Union of India & Ors - 2004-TIOL-32-SC-SECURITISATION and Transcore v. Union of India (2008) 1 SCC 125 has held that the above stated recourses shall only be available if a notice in compliance of Section 13(2) has been provided. Thus, notice under section 13(2) is a condition precedent for availment of these recourses.

Right to foreclosure

The Act in its words does not in any way imply any inconsistency with section 67 of Transfer of property act, 1882. Thus, with the recourses another thing to be noted is that the Secured creditor possesses the Right to Foreclosure. Right to Foreclosure is provided under Section 67 of the Transfer of property act, 1882. According to this section after the principal amount has become due, and before payment of mortgage money by mortgagor or before decree of redemption has been passed by the court, mortgagee has a right to obtain a decree of foreclosure from the Court. A suit to obtain a decree that a mortgagor will be absolutely debarred from exercising his right to redeem the mortgaged property is called a suit for foreclosure.

The Transfer of property act, 1882 contemplates six kinds of mortgage, namely simple mortgage, mortgage by conditional sale, usufructuary mortgage, English mortgage, mortgage by deposit of title deeds and anomalous mortgage.

Simple mortgage: The mortgagee in such kind does not get possession of the mortgaged property and therefore cannot exercise right of foreclosure. The remedy available to him is either to proceed against the mortgagor personally or for sale of the mortgaged property.

Mortgage by conditional sale: Mortgage by way of conditional sale provides that in case of default of payment by the mortgagor, mortgage will become a sale. The remedy in such a situation is not foreclosure but debarring the right of redemption available to the mortgagor.

Usufructuary mortgage: Under this kind of mortgage, mortgagee keeps the possession until repayment of money and receives rents and profits or part thereof in lieu of interest, or in payment of mortgage money or partly in lieu of interest and partly in payment of mortgage money. There is redemption only when the amount due is personally paid or is discharged by rents or profits received. He does not possess a right to foreclose or sale in this kind.

English mortgage: In case of English mortgage a mortgagor binds himself personally to pay the debt, and there is an absolute transfer of mortgaged property in favour of mortgagee. Therefore he does not possess the right of foreclosure but only a right to file a suit for sale of the mortgaged property.

Mortgage by deposit of title deeds: As per Section 96, the mortgagee of title deeds is on the same footing as a simple mortgagee, therefore remedy available is only the sale of the mortgaged property.

Anomalous mortgage: The remedy depends on the terms contained in the mortgage deed as anomalous mortgage is generally a combination of two or more types of mortgages.

Discharge of Borrower's debtor

According to clause (5) of section 13, in case any person mentioned in sub-clause (d) of section 13(4) makes any payment to the Secured creditor then it shall be deemed as if he has made such payment to the Borrower. It would account to discharge of his liabilities.

Rights of a transferee

Section 13(6) states that if Secured creditor or his manager has taken over the management or possession of the Secured asset by virtue of section 13(4) and he makes any transfer, then all rights in or relation to the asset shall be vested in the transferee. The transfer would be treated as if it had been made by the owner, himself.

The Bombay High Court in U.C.O. Bank v Kanji Manji Kothari And Co 2008 (110) Bom L R 744 has reiterated the same

"…. Any transfer of secured assets after taking possession or after taking over management of business under Section 13(4) by the secured creditor vests in the transferee all rights in relation to the secured assets. This is because thereafter assets vest in the secured creditor free of all encumbrances…"

Application of money received

In case the Secured creditor adopts any recourse available in section 13(4), then any expenses, costs and charges rightfully incurred by him or which are incidental are recoverable from the Borrower and such money when received shall be held by him in a trust. The received money has to be applied in the following chronological order:

i. In payment of above mentioned expenses, costs and charges

ii. In discharge of dues of Secured Creditor

iii. Paid to any other person entitled in accordance with his rights and interests

A clear reading of Section 13(7) which includes the above mentioned provisions depicts that while applying the money held in trust which is received by the Borrower there exist a clear priority of one over the other in which the payment of expenses, costs and charged incurred in adoption of recourse under section 13(4) taking precedence where as any third party right over such money takes the last priority.

The Hon'ble Supreme Court of India in the judgment Transcore v. Union of India (2008) 1 SCC 125 stated that

Para 27

"…the asset will vest in the bank/FI free of all encumbrances and the secured creditor would be entitled to give a clear title to the transferee in respect thereof. Section 13(7) refers to recovery of all costs, charges and expenses incurred by the bank/FI for taking action under Section 13(4). Section 13(7) provides for priority in the matter of recovery of dues from the borrower. It inter alia provides for payment of surplus to the person entitled thereto…."

Payment made by Borrower before sale

If the above mentioned costs, charges and expenses are tendered to him any time before publication of notice for public auction or inviting quotations or tender from public or private treaty by any mode of transfer of the secured assets then such assets shall not be transferred by any mode or if any step has been taken in its furtherance the no further step shall be taken. (Section 13(8) of the Act)

Sale and bidding process of Secured asset

Rule 6 of the Rules provides for the provisions pertaining to sale of movable secured assets and after the sale is made in accordance with the said rule then the authorized officer shall issue a certificate of sale as prescribed under Appendix-III of the Rules.

Rule 8 of the Rules provides for the provisions relating to sale of immovable property. In case sale of immovable property is postponed due to bid amount being less that the reserve price as decided under Rule 8(5) of the rules, then any authorized officer of secured creditor (as appointed under Section 13(12) of the Act read with Rule 2(a) of the Rules can bid for the same in any subsequent sale (Section 5A of the Act). When the secured creditor is declare as purchaser, the amount of purchase price shall be considered to be adjusted towards the claim amount(Section 5B of the Act) and the provisions of Section 9 of Banking Regulations Act, 1949, shall be applicable to this immovable property (Section 5C of the Act).

SARFAESI Act and Companies Act

Section 13(9) of the Act talks about financing of an asset by more than one secured creditor or joint financing. In this case no secured creditor can exercise any right conferred upon him under clause 4 unless exercise of such right is agreed upon by secured creditors representing not less than 60% of outstanding amount on record date and such action shall be binding on all other secured creditors.

Where a company is in liquidation then the distribution of amount realised from the sale of Secured asset shall be in accordance of Section 529A of the Companies Act, 1956 which is as follows

"(1) Overriding preferential payment. Notwithstanding anything contained in any other provision of this Act or any other law for the time being in force in the winding up of a company-

(a) workmen's dues; and

(b) debts due to secured creditors to the extent such debts rank under clause (c) of the proviso to sub- section (1) of section 529 pari passu with such dues, shall be paid in priority to all other debts.

(2) The debts payable under clause (a) and clause (b) of sub- section (1) shall be paid in full, unless the assets are insufficient to meet them, in which case they shall abate in equal proportions."

In case where a company is being liquidated after the commencement of the Act, such company shall have the following two options-

1. Relinquishment of Security: In such case the provisions of Section 529 of the Companies Act, 1956 are adopted. In this case the Secured Creditor may retain the sale proceeds of his Secured assets after depositing the workmen's dues with the liquidator in accordance with the provisions of section 529A of Companies Act, 1956. If the secured creditor has deposited only the estimated amount then he'd also be liable to deposit the balance or be entitled to receive the excess

2. Realization of security: In such case all provisions of SARFAESI Act are adopted.

The relationship between the Companies Act and SARFAESI Act was clearly defined by The Hon'ble Supreme Court of India in the case of Pegasus Assets Reconstruction Private Limited v M/s Haryana Concast Limited and Anr

"…. intent behind enactment of the legislation was to enable a secured creditor to enforce security without the intervention of a court or tribunal. The Supreme Court observed that enabling an official liquidator appointed during the course of winding-up of a company to wield control over the realization of security interest by a secured creditor would result in a conflict of interests and rights granted to the official liquidator and the secured creditor under the respective statues…."

Right of Secured creditor in case of inadequate sale

A secured creditor under Section 13(10) has the right to file an application either under Debts Recovery Tribunal having appropriate jurisdiction or a competent court, if he is not satisfied with sale proceeds.

Independent right for enforcement of pledge and guarantee

Under section 13(11) the secured creditor shall be entitled to proceed against the guarantors or sell the pledged assets without first taking any of the measures specified in clauses (a) to (d) of subsection (4) in relation to the secured assets under this Act.

Conclusion

The entire structure of section 13 of the Act provides definite way to the financial institutions to realize their Security and convert any NPA into a performing asset and thus, decreasing their losses.

(The author is a fourth-year B.A.L.L.B student in Vivekananda Institute of Professional Studies, affiliated to GGSIP University, New Delhi. The views expressed are strictly personal.)