Merger and Acquisition: New and Old

Published: Nov 27, 2017

Running a Company is nothing less than a creative activity which exists due to combined efforts with the ability to manage, own, expand and improvise! This creative activity gives rise to a merger or an acquisition.

What is Merger/ Acquisition

The term Mergers and acquisitions (M&A) refers to consolidation of companies. Differentiating the two terms precisely, Mergers includes a combination of two or more companies to form one, while Acquisitions is said to take place when one company which is larger in size takes over a company which is generally smaller in size. M&A being a crucial aspect of the corporate world holds great value in an emerging economy like that of ours.

The Income Tax Act, 1961 under Section 2(1A), defines an amalgamation as the merger of one or more companies with another or the merger of two or more companies to form a new company. According to this definition, mergers/amalgamations in India are classified under the following two heads namely-

- Mergers through Absorption, which take place when there is a combination of two or more companies into an existing company, in this case all the companies except one, lose their identity/legal status.

- Mergers through Consolidation takes place where a combination of two or more companies is made to forma new company, in this case all the companies are required to be dissolved and a new entity is incorporated.

Under both these heads, post amalgamation, the assets and liabilities of the amalgamating companies becomes the assets and liabilities of the amalgamated company (the newly formed company).

On the other side, an Acquisition is merely acquiring the ownership in a Company. It is the purchase by one company interested in controlling the share capital of the other company. Even after the takeover, although there is a change in the management of both the companies, each one of them retains their separate legal identity. The Companies remain independent and separate and the only difference includes the change in control of the Companies.

When and why would a company opt for M&A activity?

Considering a Merger or Acquisition for a company involves corporate restructuring which is the process of changing a company's business model, management or financial structure resulting into an increase in shareholder value to cultivate a flowering strategy take place. The following are some major reasons for undertaking a Merger/ Acquisition.

- Financial synergy for lower cost of capital

- Improving company's performance and accelerate growth

- Ranging Economies

- Diversification for higher growth products or markets

- Pre-empt competition

- Increased market share

- Strategic realignment and achievement of technology

- Taxation perks

- Undervalued target

- Division of Risk

Examples of Tech Acquisitions on how they succeeded by taking timely action

Takeover of WhatsApp by Facebook

Facebook closed its deal of taking over the largest spread messaging startup WhatsApp, after receiving the go-ahead from European Union regulators. However, WhatsApp CEO Jan Koum kept his position as Facebook board member safe, and has an "inducement grant" of stock if he continues with the company for the subsequent four years post acquisition. The deal price, originally announced in February 2014 as $19 billion which was later revised to $21.8 billion, primarily because the value of Facebook stock had increased.

- Takeaways from this Acquisition-

The user volume and engagement of WhatsApp was growing faster than that of Facebook in 2014, so instead of competing with WhatsApp, Facebook back then thought of Acquiring, thus leading to a bold move by the acquirer, which offered many advantages to them including a larger user base in the direct messaging arena, smartphone engagement, and high international penetration across various demographics. Post-Acquisition, the users of WhatsApp and their time belonged to Facebook. So buying WhatsApp allowed Facebook to both own "the next Facebook" and prevent "the next Facebook".

Acquisition of LinkedIn by Microsoft

Microsoft acquired the biggest company into social media networking for professionals, LinkedIn for a smooth $26.2 billion in an all-cash deal. That took LinkedIn's stock up 47% in trading. The deal, Microsoft's' largest ever by a $20 billion long shot is said to accelerate the growth of LinkedIn, as well as Microsoft Office 365 and Dynamics.

Analyzing and strategizing a deal

Stages of any M&A deal

- Pre-acquisition review of potential targets : this stage includes assessment of the acquiring company with regards to the need for M&A, ascertain the valuation and pitch the growth plan through the target.This would also include searching for the possible companies. This process is mainly to search for an appropriate strategic fit for the purpose of acquisition.

- Valuation by way of Due Diligence : Once the appropriate company is shortlisted through primary search and screen, detailed reporting of the target company is required in order to know whether the company is sinking or floating by way of a due diligence activity.

- Negotiating terms : Once the potential target company is finalized, the immediate step is to negotiation the terms and come to common consensus for a negotiated merger. This brings both the companies to agree mutually to the deal for the long term working of the M&A.

- Approvals with relevant sectoral bodies : the terms of negotiation majorly depend on the sector in which the potential merging companies fall, additionally, if either of the company is listed along with sectoral compliance the relevant stock exchange and SEBI come into picture. This stage is important on account of timelines of closing a deal which is something imperative to look at.

- Post-merger : If all the above steps fall in place, there is a formal announcement of the agreement of merger or a scheme of arrangement by the potential merging companies.

Modes of giving effect to a Deal

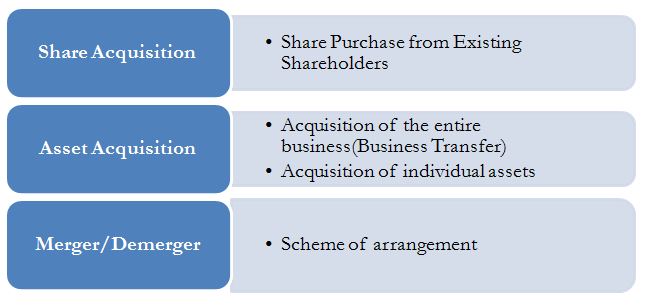

Generally, deals are closed in either of the following ways-

A purchase of assets can be achieved through either a purchase of a business on going concern basis or a purchase of individual assets. The acquisition of business could be one of either type- a ‘slump-sale' or ‘itemized sale' basis. The sale of a business undertaking i.e. a business transfer is on a slump-sale basis when the entire business is transferred as a going concern for a lump-sum consideration. An itemized sale occurs either where a business is purchased as a going concern and the consideration is specified for each asset or where only specific assets or liabilities are transferred.

Due Diligence- a gateway Deal or no Deal

Due Diligence is the process of evaluating a business situation diligently on key notes before take a conclusive decision which is binding. At any given point of transaction, due diligence facilitates the buyer in uncovering potential liabilities and discrepancies and repercussions enabling the buyer to take a right decision. There are various forms of due diligence depending upon the area of coverage, however, from the perspective of an M&A activity the financial due diligence, legal due diligence, operational/secretarial due diligence are advised.

Laws/ regulatory framework governing Merger/Acquisition in India

- Companies Act, 2013

The Companies Act, 2013 under Section 232 permits Mergers and Acquisitions, whereas, Section 230-240 cover the entire sphere of Mergers, Acquisitions, Compromise & Arrangements in India.The National Company Law Tribunal considers the merger application to give effect to the merger only after the company concerned has complied with the provisions of Sections 230 to 234 of the Companies Act 2013 and the Companies (Compromises, Arrangement and Amalgamation) Amendment Rules, 2017.

Following sections of Companies Act, 2013 deals with M&A.

- Power to Compromise or make arrangements with creditors and members is covered under Section 230 of the Companies Act, 2013

- Power of the NCLT to enforce a compromise or an arrangement is laid down under Section 231of the Companies Act, 2013

- Mergers &Amalgamation including demergers falls within Section 232 of the 2013 of the Companies Act, 2013

- Amalgamation of small companies and certain type of companies falls under Section 233 of the Companies Act, 2013

- Section 234 of the Companies Act broadly applies to scheme of mergers and amalgamations between Indian companies and foreign companies (Cross border mergers) incorporated in foreign jurisdictions notified by the Central Government.

The Ministry of Corporate Affairs of the Government of India by way of a notification has notified Section 234of the Companies Act, 2013 enabled cross-border mergers with effect from April 13, 2017. The MCA has also notified the Companies (Compromises, Arrangement and Amalgamation) Amendment Rules, 2017 to insert Rule 25-A which deals with cross border mergers to the Companies (Compromises, Arrangement and Amalgamation) Rules, 2016. Rule 25-A has brought into operation the scope of the application of Section 234 of the Companies Act, 2013. (The procedure of undertaking Cross border Mergers& Acquisitions is explained later in this paper)

Provision related to Fast Track Mergers- Section 233 of Companies Act, 2013 read with Rule 25 of Companies (Compromises, Arrangements and Amalgamations) Rules, 2016 deals with the procedure of Fast Track Merger. This is a new insertion in the 2013 Act which helps in easing the procedure of merger to the eligible companies.(The applicability & procedure of Fast Track Mergers under Companies Act, 2013 is discussed later)

- Securities laws and SEBI guidelines

When the acquired shares are listed on any recognized stock exchange in India, the acquirer is required to comply with the provisions of the securities laws applicable to listed companies which are prescribed by the Securities and Exchange Board of India (Substantial Acquisition of Shares and Takeovers)Regulations, (Amendment) 2017 (Takeover Regulations) which came into force from August 14, 2017 by way of amendment to the pre-existing SEBI (Substantial Acquisition of shares & Takeovers Regulations, 2011.

Under the Takeover Regulations, SEBI has prescribed that in the event of acquisition of shares or voting rights of a listed company,entitling the acquirer to exercise 25% or more of the voting rights in the target company or acquisition of control, the acquirer is obliged to make an offer to the remaining shareholders of the target company for acquiring at least 26%more voting rights.

Any merger or demerger involving a listed company would require prior approval of the stock exchanges and SEBI before approaching National Company Law Tribunal. Further, under the Takeover Code, a merger or demerger of a listed company usually does not bring about an open offer to the public shareholders.

- Foreign exchange regulations

Sale of equity shares involving residents and non-residents is permissible subject to prior approval of RBI pricing guidelines and permissible sectoral cap. A typical merger/demerger involving any issuance of shares to non-resident shareholders of the transferor company does not require prior RBI/government approval provided that the transferee company does not exceed the foreign exchange sectoral cap and the merger/demerger is approved by the Indian courts. Issuance of any instrument other than equity shares/compulsorily convertible preference shares/ compulsorily convertible debentures to the non-resident is mandated with procedures under Foreign Exchange Management Act, 1999 ("FEMA") to be complied as they are considered as debt.

Most of the sectors in India are with open gates for foreign investment, thus no approvals from the government of India required for the issue of new shares with respect to these sectors (i.e. automatic route). However, certain sectors are regulated and subject to restrictions/prohibitions of foreign investment that require the foreign investor to apply to the government of India for a specific approval (i.e. approval route).

- Regulations under The Competition Act, 2002

Under Competition Commission of India (CCI) regulations, a business combination that causes or is likely to cause an appreciable adverse effect on competition within the relevant market in India shall be void. Any acquisition of control, shares, voting rights or assets, acquisition of control over an enterprise, or merger or amalgamation is regarded as a combination if it meets certain threshold requirements and accordingly requires approval.

- Indian Stamp Act, 1899

The Indian Stamp Act, 1899, provides for stamp duty on transfer/issue of shares at the rate of 0.25%. In case the shares are in dematerialized form, there would be no stamp duty on transfer of shares. Conveyance of business under a business transfer agreement in the case of a slump sale is charged to stamp duty at the same rate as in the case of conveyance of assets. The exact rate of stamp duty levied depends upon the respective state laws i.e. place of registered office or place the agreement shall be brought into force.

Apart from the above regulations and regulators under them, we have a few sectoral authorities, approvals of which are mandatory while dealing with any M&A activity involving that sector, e.g.

- Insurance Regulatory and Development Authority of India (IRDAI)regulates the Insurance sector

- Telecom Regulatory Authority of India (TRAI)regulates the Telecom sector

Tax Implications&suitable Business Structures

Implications under the Income Tax Act, 1961

Tax implications are divided into the following three perspectives:

- Tax concessions to the Amalgamated (Buyer) Company:

Tax benefits in case of amalgamation by way of absorption:

- Section 72A of the Income-Tax Act, 1961, contains provisions relating to carry-forward and set-off of the accumulated loss and unabsorbed depreciation allowance in case of re-organisation/restructure of business by way of amalgamation or demerger, etc.This section deals with the mergers of sick companies with healthy companies. The amalgamated company enjoys the advantage to carry forward the accumulated losses and unabsorbed depreciation of the amalgamating company.

- Section 36(1)(vii) of the Income Tax Act covers treatment of bad debts: When on account of as amalgamation debts of the amalgamating company are taken over by amalgamated company, and subsequently, such debts turn out to be bad, such bad debts are allowed as deduction to the amalgamated company.

- Section 35ABB (6) of the Income Tax Act mentions that when the amalgamating company transfers by way of sale licence to operate telecommunication services under any scheme of arrangement to the amalgamated company-

a. The expenditure on acquisition on license, not yet written off, shall be allowed to the amalgamated company in the same number of balance installments.

b. Where such licence is sold by the amalgamated company, the treatment of the deficiency/surplus will be same as would have been in the case of amalgamating company.

- Section 35(5) of the Income Tax Act covers expenditure on scientific research: When an amalgamating company transfers any asset represented by capital expenditure on the scientific research to the amalgamated Indian company the provisions of section 35 of the Income Tax Act shall be applicable-

a. Unabsorbed expenditure on scientific research of the amalgamating company will be allowed to be carried forward and set off in the hands of the amalgamated company.

b. If such asset ceases to be used in the previous year for scientific research related to the business of amalgamated company and is sold by the amalgamated company the sale price to the extent of the cost of asset shall be treated as business income and the excess of sale price over the cost shall be subject to the provisions of capital gain.

- Section 35DD of the Income Tax Act: deals with amortization of expenditure in case of amalgamation and states that expenditure incurred in connection with the amalgamation the assessee shall be allowed to deduct an amount which is equal to one-fifth of such expenditure for each of the five successive previous years beginning with the previous year in which the amalgamation takes place.

- Section 35D(5) of the Income Tax Act deals with treatment of preliminary expenses in case of amalgamating company when it merges with an amalgamated company under a scheme of amalgamation.

- Section 36(1)(ix) of the Income Tax Act lays down the outcome when capital expenditure on family planning is shown: if Asset representing capital expenditure on family planning is transferred by the amalgamating company to the amalgamated company under a scheme of amalgamation, such expenditure shall be allowed as deduction to the amalgamated company in the same manner as would have been allowed to the amalgamating company.

- Tax concessions to the Amalgamating (Seller) Company:

- Section 47(vi) of the Income-tax Act covers the exemption from the capital gains which says that capital gain arising from the transfer of assets by the amalgamating companies to the Indian Amalgamated Company is exempted from tax as such transfer will not be covered as a transfer for the purpose of Capital Gain.

Exemption from Capital Gains Tax in case of International Restructuring [Sec. 47(vi)(a)]: Under this Section, in case of amalgamation of foreign companies, transfer of shares held in Indian company by amalgamating foreign company to amalgamated foreign company is exempted from tax, if the following two conditions are satisfied:

a. At least twenty-five per cent of the shareholders of the amalgamating foreign company continue to remain shareholders of the amalgamated foreign company, and

b. Such transfer does not attract tax on capital gains in the country, in which the amalgamating company is incorporated.

- Tax concessions to the shareholders of an Amalgamating Company:

Shareholders of an acquired corporation can receive many payments when they sell their shares due to a merger or acquisition. Such receipts of various forms of payment may be deemed taxable or nontaxable. If they are taxable, then the shareholders must pay capital gains taxes on their gain over basis.

- Under section 47(vii) of the Income-tax Act, covers capital gains arising from the transfer of shares by a shareholder of the amalgamating companies and states that they are exempted from tax as such transactions will not be regarded as a transfer for capital gain purpose, if the following two tests are satisfied-

a. The transfer is made in consideration of the allotment to him of shares in the amalgamated company; and Amalgamated company is an Indian company.

The legal framework for business consolidations in India consists of various statutory tax concessions and tax-neutrality for certain types of reorganizations and consolidations. Several attempts are made to simplify the tax regime of India, frame it transparent, fill in the loopholes and thus reduce the uncertainty caused by litigation at various stages.

Cross border Mergers& Acquisitions

Till now, it was possible for a foreign company to merge with an Indian company although it was not possible for an Indian company to merge with a foreign company within the court sanctioned merger framework set out under Indian corporate law. This finally changed in April 2017, when the company law provisions that govern cross border mergers were brought into force. In the same month, the Reserve Bank of India also issued draft regulations setting out the conditions for obtaining ‘deemed' approval from the RBI for cross border mergers. Now, companies in India desirous of merging with a foreign company may do so.

- The provisions of cross border mergers are applicable both inbound and outbound merger-

- Inbound Merger means "Merger of foreign Company, incorporated in any jurisdiction outside India with a Company incorporated in India".

- Outbound Merger means "Merger of an Indian Company, with a Company Incorporated in any jurisdiction covered under below mention Annexure A of the procedure of undertaking cross border merger".

The corresponding amendment in Tax Laws is awaited as unlike domestic mergers there is no specific tax exemption for outbound mergers.

Fast Track Mergers under Companies Act, 2013

- Applicability of the provision: a fast track merger under section 233 can only be conducted by the following companies-

- It can be conducted between two or more small companies (companies with paid-up capital less than INR 5 million and turnover less than INR 20 million); or

- Between a holding company and its wholly-owned subsidiary company; or

- Between any other class or classes of companies as may be prescribed.

- The following companies are an exception to section 233 i.e. not covered under the ambit of fast track mergers:

- Public companies (except amalgamations involving holding and wholly-owned subsidiary companies);

- Section 8 companies; and

- Companies or corporate entities governed by any special Act.

Acquisitions declared in October 2017

- Acquisition of Hypercity Retail India Ltd (HRIL) by Future Retail Ltd (FRL)

FRL executed Share Purchase Agreement with Shoppers Stop for acquisition of its entire share capital at INR 655 crore of its Subsidiary Hypercity Retail in stock-and-cash deal. On completion of the transaction HCL will become a wholly owned subsidiary of FRL. The proposed deal is Subject to receipt of requisite regulatory and other approvals.

Future Retail said in a stock-exchange filing it will pay INR 155 crore in cash and issue shares worth INR 500 crore. The company will allot 9.31 million shares at Rs. 537 apiece. The acquisition would result in further consolidation of retail business of FRL and would increase footfall of FRL in Hypermarket segment.

Shopper Stop owns 51.09% stake in HRIL and rest is owned by the promoter K. Raheja group, Hypercity operates 19 large format premium stores in some key cities from the promoter's firm Shoppers Stop.

Future Retail, that owns four major retail brands, will find HyperCity sit somewhere between its existing Big Bazaar departmental store network and Foodhall, a premium upscale gourmet store. It is unclear how HyperCity will be integrated in Future Retail's clearly defined networks. Big Bazaar has 235 stores in India which have been undergoing an upgrade from a go-to destination for discounts to a lifestyle departmental store. FRL is set to focus on small stores, building a network under brand names Easyday and Heritage.

Acquisitions concluded in the recent past

- Rosneft's Essar Oil acquisition (Energy Sector)

The nearly $13-billion acquisition of Essar Oil Ltd by a consortium led by Russia's Rosneft PJSC was completed in October 2017. Russia's largest oil producer Rosneft has successfully closed a deal to buy a 49 per cent stake in Essar Oil Ltd. The intent of the said partial acquisition is that after partnering Rosneft intends to support the company in significantly improving its financial performance which at present is in total estimated debt of close to Rs1.3 trillion by equity brokerages and in the medium term adopt an asset development strategy.

The deal which is said to be the largest foreign direct investment of this sector, includes the sale of a 20 million-tonnes-per-year Vadinar refinery and Vadinar port in Gujarat to Rosneft.

United Capital Partners and Trafigura Group Pte Essar's promoters, the Ruias, will retain a 2% stake in these assets. The deal is expected to wipe out a substantial part of the holding company's debt. About $5 billion debt at the operating company level (Essar Oil, Vadinar Port and Vadinar Power) would be transferred to Rosneft, while another $5 billion would go into deleveraging the holding company. A substantial part of the proceeds would get into restructuring the debt of Essar Steel Ltd.

Essar steel being one of the largest defaulters identified by the Reserve Bank of India for early insolvency proceedings, the Ahmedabad bench of the National Company Law Tribunal had admitted the insolvency petition against Essar Steel. The firm owed lenders about Rs. 45,000 crore, of which Rs. 31, 671 crore had become non-performing as of 31 March 2016. The company owes as much as 93% of this amount to a consortium of 22 creditors led by State Bank of India.

- Tech Mahindra acquired UK-based Target Group at around 120-million pounds.

Tech Mahindra acquired 100 percent shares in UK-based BIO Agency (BIO) in an all-cash deal for an enterprise value of up to 45 million pounds which was intended to increase the digital services portfolio of Tech Mahindra.

The consideration is the enterprise value of 40 million pounds plus surplus cash not exceeding 5 million pounds as at the completion date. The payment of 22 million pounds and the surplus cash will be made upfront and the balance as deferred payments from 2017 to 2019 based on the company performance during the period FY2017-19.

BIO services brands across financial services, retail, property, travel, and technology sectors, this acquisition for BIO will bring forth synergy which was visualized to bring in more clients for BIO globally (especially in Europe and the US), scaling their offering geographically and enabling new services and deeper Digital Change.

For Tech, the acquisition will further strengthen and enable the company to engage with its clients at the start of the journey and help design the customer experience for their businesses. Together this combination will create one of the world's leading innovation practices. A combination of BIO's visionary thinking and delivery with Tech Mahindra's IT to DT (Digital Transformation) strategy will enable and create digital services, that get industries ready beyond just technology transformation to customer satisfaction.

Reasons why deals fail

While keeping the good side of merger in mind they are expected to create value, enhance a company's market power and position, or help utilize tax credits the other side does not picture of everything being rosy. Like a few relationships which turn to be bitter at a later stage, mergers in extreme cases can also turn cold. Mergers usually go wrong due to the following circumstances-

- Poor strategic fit and result of not wisely choosing the target

- Poorly managed Integration and governance

- Incomplete due diligence leading to lack of clarity with respect to condition precedent, condition subsequent specific indemnities and warranties

- Errors in estimations and projections

- Burdensome government compliances

- Lack of corporate understanding of the nature of business

- Poor allocation of resources and assets, etc.

We can say that giving edge to an enterprise is an art!

- Merger which failed miserably (Demerger of Daimler-Benz and Chrysler)

The German automaker Daimler-Benz in 1998 merged with Chrysler for $36 billion, which was then regarded as one of the largest industrial mergers ever. But the potential global powerhouse turned out to be a huge disappointment. Cultural differences between the functioning of both the companies immediately caused a rift between both of them. Daimler being known for luxury brands and affluent customers didn't understand the price-conscious concerns of the U.S. automaker Chrysler. Deeply concerned that sharing the Mercedes components would undermine its brand, the German company broke its parts-sharing agreement with Chrysler. With shareholders calling Chrysler an "affliction," Daimler essentially paid Cerberus Capital Management $650 million in 2007 to take Chrysler off its hands.

Our Observation

Growth is the substance each corporation runs behind. For achieving this substance the existing organization usually prefers restructuring by exploiting the advantages and overcoming the drawbacks. Depending on the facts of the specific case, the optimal mode of implementing the transaction could be shortlisted. The rationale behind M&A is that when two entities meet together more value is created than that created individually. Despite all negative effects, M&A continues to be an important tool of a company's growth.

(CA Sudha G. Bhushan is a Chartered Accountant and international Transaction Advisor)

(Roshni Patel is a final year student of SVKM's Pravin Gandhi College of Law, Mumbai)